|

Dear valued client,

Ready to spend as much as you like? Standard Chartered brings you an exclusive offer to enhance your financial flexibility and allows you to enjoy stress-free spending!

Selected clients* who apply online successfully for an instalment plan on or before 31 October 2021, can enjoy up to HKD500 spending rebate^ and Monthly Handling Fee as low as 0.15%#, with minimum retail spending HKD500 only.

|

|

|

Illustration:

| Transaction amount |

Monthly handing fee(%)# |

Daily handling fee+ |

| HKD1,500 |

0.15% |

HKD0.08 |

| HKD25,000 |

0.15% |

HKD1.25 |

|

|

Easy application in 5 minutes

You can apply for the Statement Instalment Plan in a few easy steps online or login to SC Mobile.

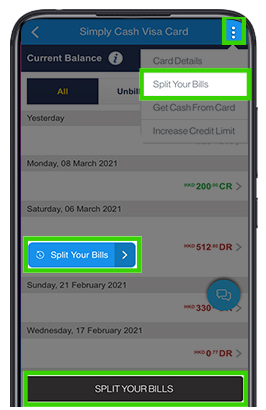

Apply via " " or choose your credit card account on SC Mobile and click "Split your bills". " or choose your credit card account on SC Mobile and click "Split your bills".

All images, contents and interest rates are for reference only.

|

|

What’s more, if you need extra cash, you can apply for our “Instalment Credit” Programme in order to get extra cash of up to 18 times of your monthly salary, with instant approval in 30 seconds with one click!

Apply online successfully for both Statement Instalment Plan and Instalment Credit Programme on or before 31 October 2021 for an extra HKD100 cash rebate@!

|

|

We value your feedback - Was this email useful? |

|

|

Standard Chartered has been awarded the Best Retail Bank Hong Kong and the Best Digital Bank Hong Kong in 2020 by The Asian Banker.

|

|

|

Remarks:

* Only selected clients who have received this invitation mobile message/email directly from Standard Chartered Bank (Hong Kong) Limited.

^ In order to enjoy up to HKD500 cash rebate, clients shall successfully apply for instalment Credit Program of at least HKD5,000 with a tenor of 12 months via online and such application shall be approved by Standard Chartered bank (Hong Kong) Limited as shown in the table below during the promotion period from 1 to 31 October 2021.

| Loan Amount (HKD) |

Cash Rebate (HKD) |

| $5,000 - $14,999 |

$50 |

| $15,000 - $24,999 |

$200 |

| $25,000 or above |

$500 |

# For transaction amount of HKD1,500 or HKD25,000, the Annualised Percentage Rate (APR) of 0.15% Monthly Handling Fee is 3.31% (6-month); 3.46% (12-month); 3.51% (18-month); 3.53% (24-month). This APR does not include cash rebate.

An APR is a reference rate which includes the basic interest rates and other applicable fees and charges of a product expressed as an annualized rate. In general, the Instalment Amount is a fixed amount to be charged to the Card Account on a monthly basis, while the APR for the first instalment may be impacted by the loan disbursement date.

+ Daily handling fee is calculated based on 30 days per month.

@ To be eligible for and enjoy extra HKD100 Cash Rebate, Eligible Clients shall successfully apply for both a Credit Card Statement Instalment Plan and an Instalment Credit Program via SC Mobile App or online during 1 to 31 October 2021, and such applications shall be approved by the Bank.

Terms and conditions apply. Please type  into your browser for details or call our hotline as 2886 9770. into your browser for details or call our hotline as 2886 9770.

To borrow or not to borrow? Borrow only if you can repay!

The responses you provided will be collected on an anonymous basis, which will be processed by us in confidence for the purposes of evaluating our products and conducting related analysis. NO personal or confidential information will be collected. Please be reminded NOT to disclose or input any personal or confidential information.

Why type in website URLs into browser instead of clicking?

To safeguard your personal information against inappropriate use or unauthorised access, genuine emails sent by Standard Chartered will never embed any hyperlink directly to the online or mobile banking login page, or request you to provide or confirm login details for online banking or personal information. We understand that you are accustomed to clicking on links and logging in directly, but typing our correct website address on the online browser address bar ensure you are accessing the Standard Chartered website.

|

.

. .

.